Programs supporting the rehabilitation of historic properties can trace their origins to the federal National Historic Preservation Act of 1966 and the Tax Reform Act of 1976. These acts established the National Register of Historic Places, State Historic Preservation Offices (or SHPOs), and the Federal Historic Preservation Tax Incentive Program (also known as the Investment Tax Credit or ITC). The federal Investment Tax Credit has been called by the National Park Service, “one of the Federal government’s most successful and cost-effective community revitalization programs,” and has encouraged a substantial amount of private investment in historic preservation. This program has also inspired a number of state tax credit programs, including in Colorado, where recent amendments promise to greatly expand investment in the rehabilitation of historic buildings, especially commercial properties. History Colorado, the state’s SHPO, also supports other programs that encourage historic preservation activities, principally the State Historical Fund, which makes a portion of the state’s gaming revenue available to support preservation projects with public benefits across the state.

In order to account for changes in the value of a dollar (i.e., inflation) over the scope of this study (1981 to 2015), values used throughout this section of the report have been adjusted to the value of a dollar in 2015 using the Consumer Price Index provided by the U.S. Bureau of Labor Statistics for the Denver-Boulder-Greeley metropolitan area. Dollar values not adjusted for inflation, are given in parenthesis. The graphics show 2015 dollar values.

Preservation led to $3.9 billion of additional economic output since 1981, adding $2.2 billion to Colorado’s GDP.

State Historical Fund

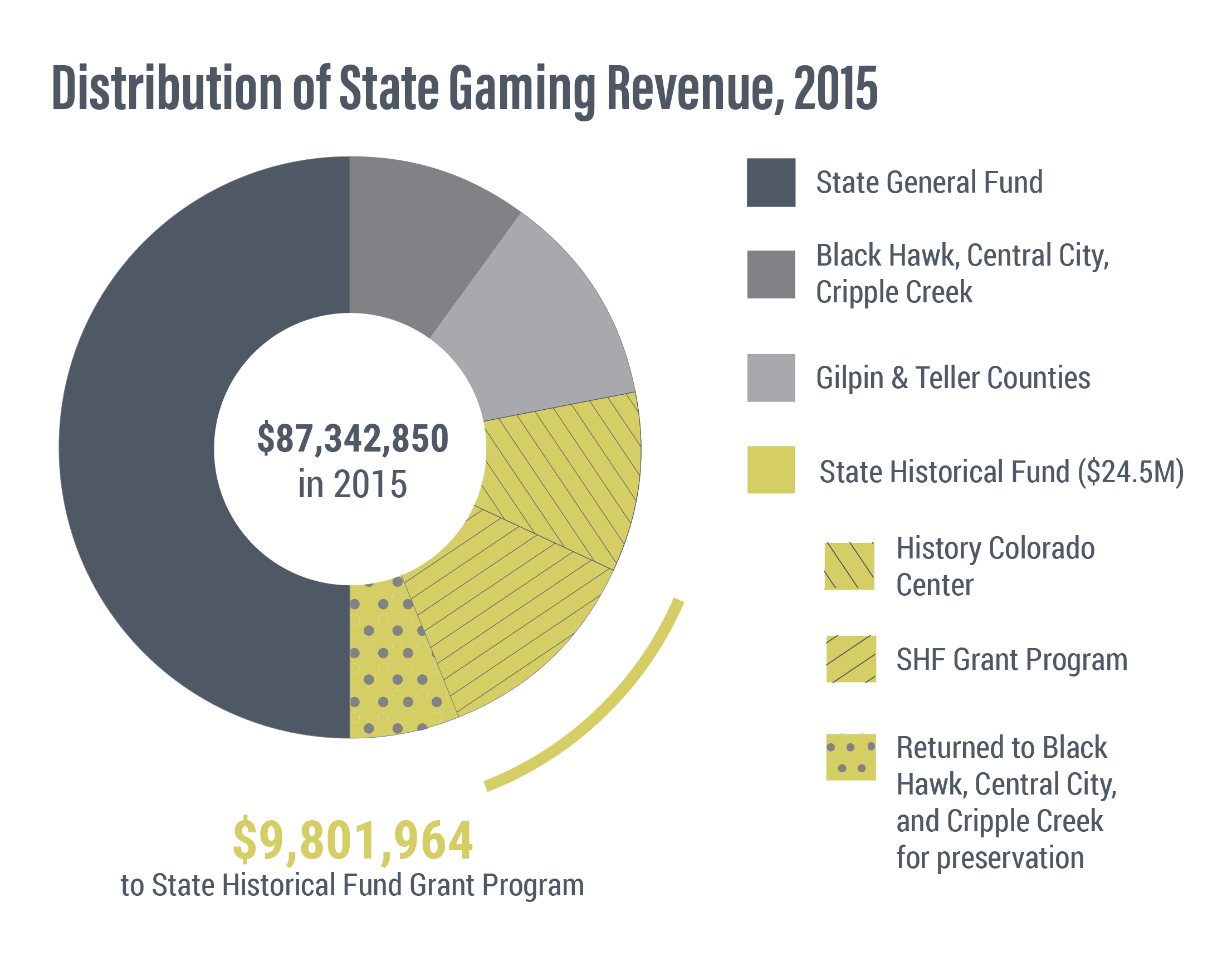

Funded through state gaming revenues, the mission of the State Historical Fund (SHF) is “to foster heritage preservation through tangible and highly visible projects for direct and demonstrable public benefit.” The SHF awards grants to public or non-profit entities in Colorado engaged in a range of historic preservation activities. This report focuses primarily on the Acquisition and Development (or A&D) grants, which are awarded to projects involving the excavation, stabilization, restoration, rehabilitation, reconstruction, or acquisition of a designated property or site, as these projects largely involve expenditures on construction and other related activities that have quantifiable economic impacts. To be eligible for an A&D grant, the structure, building, site, or object subject to the grant must be designated through a local designation process, or listed in the State Register of Historic Properties or the National Register of Historic Places at the time of application. Most of the grants distributed from the SHF (including all of the A&D grants) require a matching contribution from applicants, further leveraging funds awarded to applicants. A&D grants are currently limited to $200,000, although most are awarded in smaller amounts. The average size of grants awarded for A&D projects in 2015 was approximately $100,000, similar to previous years.

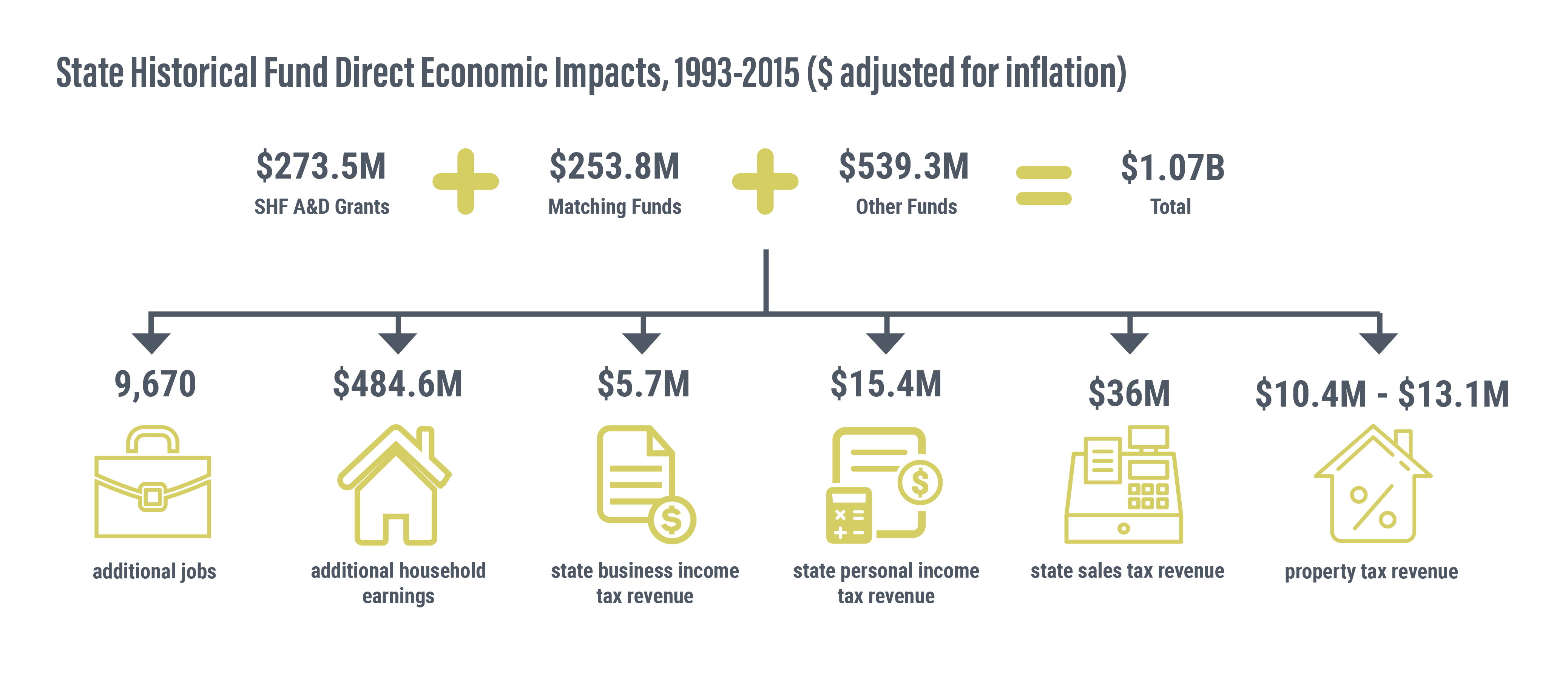

Economic Impacts of the State Historical Fund

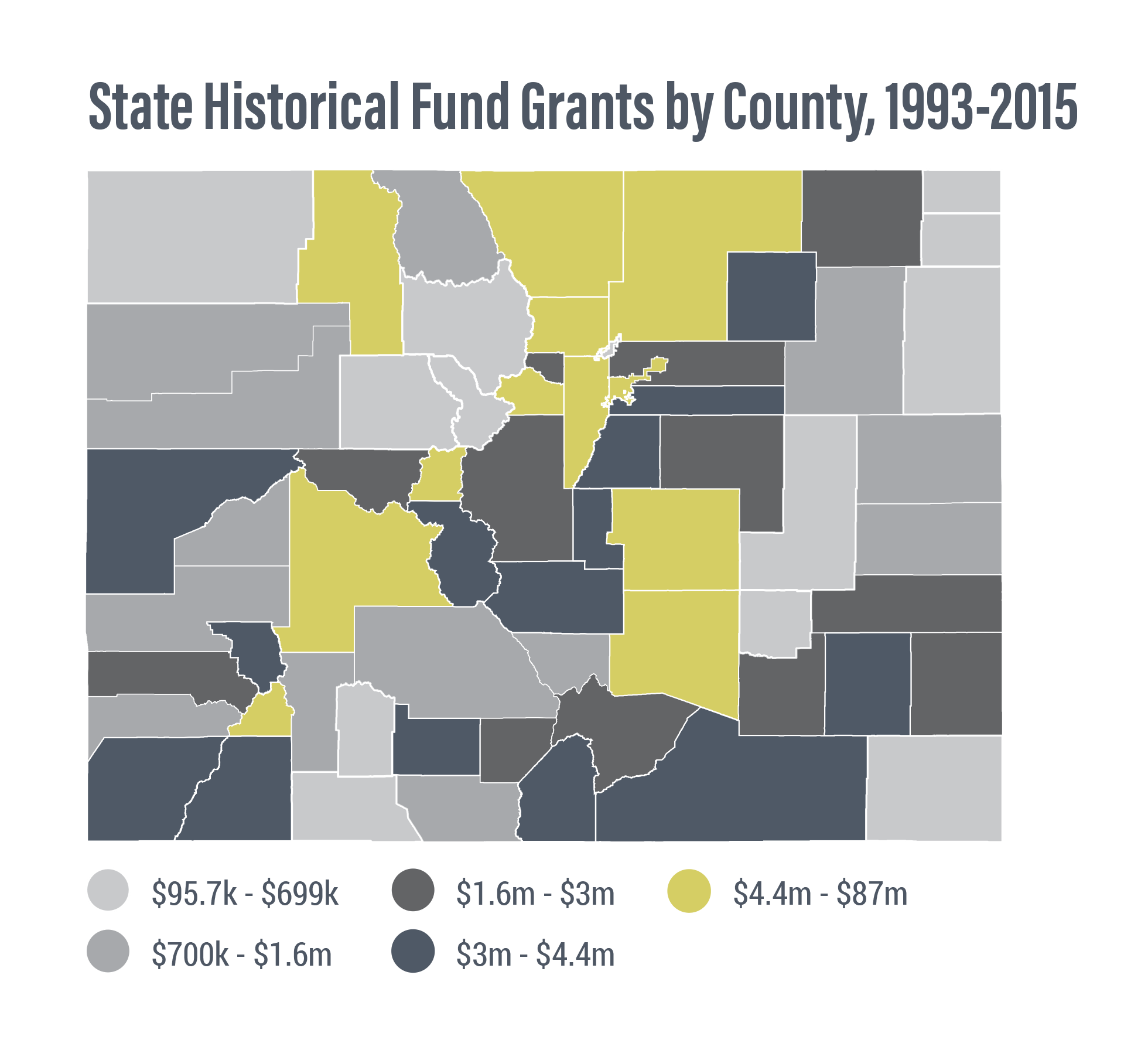

Between 1993 and 2015, the State Historical Fund contributed almost $360 million ($280 million in non-inflation-adjusted dollars) to nearly 4,320 projects across Colorado. Of these, 2,027 grants (or 48 percent) were awarded to A&D projects with a total value of $273.5 million ($212.5 million). Matching contributions and other funds spent on these A&D projects totaled approximately $793.1 million ($536.2 million) over the same period, for a total impact of $1.07 billion ($748.8 million) to Colorado’s economy. The economic benefits attributable to the SHF were felt across the state, with nearly 44 percent of A&D grant funds between 1993 and 2015 going to projects located in the state’s mountain and rural communities.

Rehabilitation Tax Credits

Federal Tax Credit

Congress established the Federal Historic Preservation Tax Incentive Program in 1976, to be administered by the National Park Service (NPS) in cooperation with the Internal Revenue Service (IRS) and the nation’s SHPOs. The program encourages private investment in the rehabilitation of historic buildings by offering significant tax credits to property owners. Two tax credits are available, the most well-known of which is a 20 percent tax credit for the rehabilitation of buildings either listed in the National Register of Historic Places or located within a National Historic District that have been certified as contributing to the historic significance of the district. This credit may only be awarded to owners of commercial, industrial, agricultural, or rental residential buildings, and is not available for the rehabilitation of private residences. The NPS must approve any rehabilitation taking advantage of this incentive and requires that the rehabilitation work follow the Secretary of the Interior’s Standards for Rehabilitation. The second incentive is a 10 percent tax credit that is available for the rehabilitation of any non-residential building built prior to 1936 (rental residential properties are ineligible) and does not need to be reviewed by the NPS or follow the Secretary of the Interior’s Standards for Rehabilitation.

Both tax credits may only be used to offset “qualified rehabilitation expenditures,” or money spent on costs associated with the work undertaken on the historic building, such as architectural and engineering fees, site survey fees, legal expenses, development fees, and other construction-related costs. The two federal tax credits are mutually exclusive, such that a project can only take advantage of the 20 percent tax credit or the 10 percent tax credit. However, projects receiving a federal tax credit may also be eligible to receive additional tax credits, such as those offered through the Low Income Housing Tax Credit program or Colorado’s rehabilitation state tax credit program.

State Tax Credit

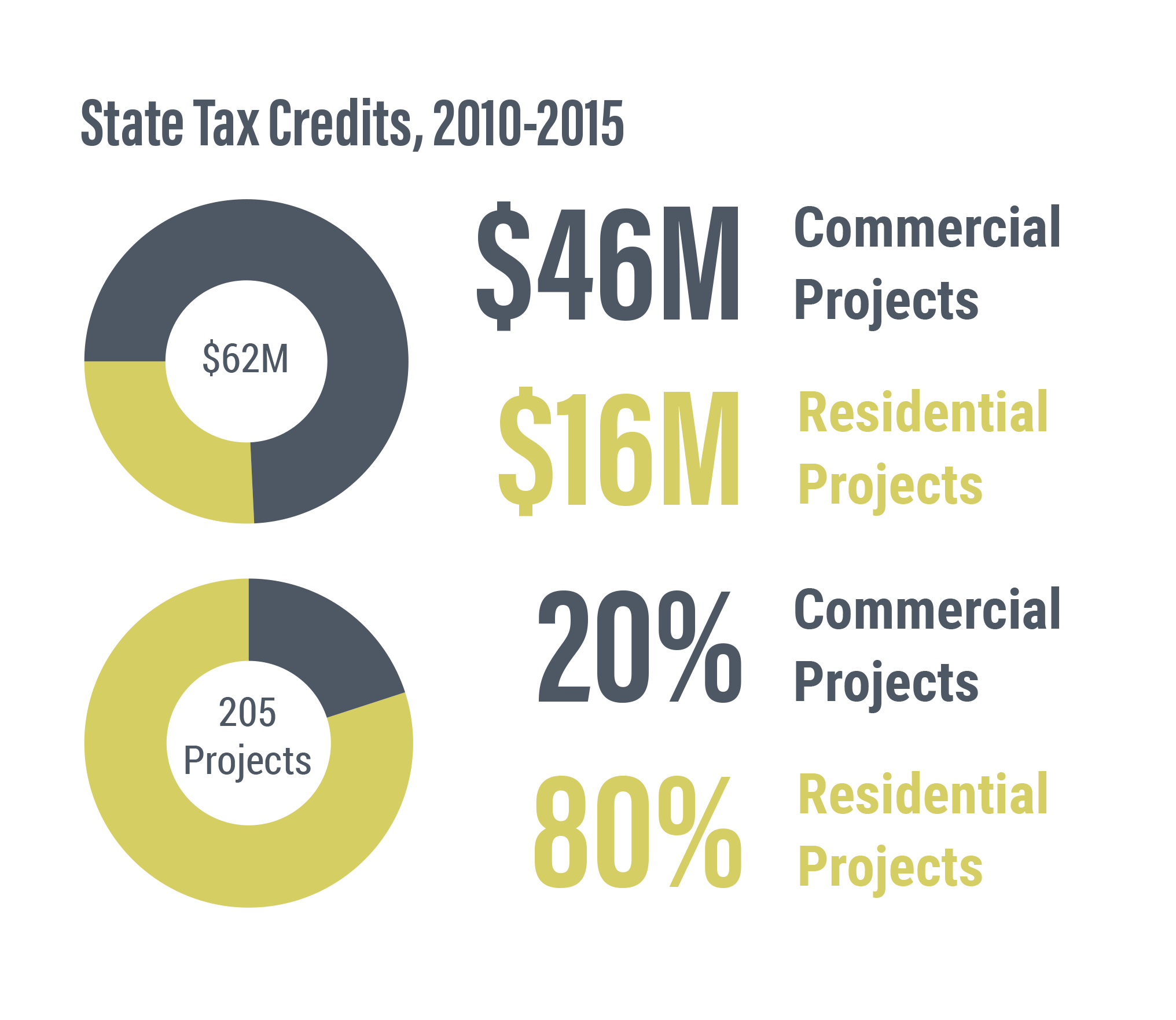

Colorado is among more than twenty states in the nation with a state-level rehabilitation investment tax credit program. Effective since 1991, the state tax credit (or STC) has been reauthorized numerous times. Properties eligible for the STC must be at least 50 years old and be listed in the National Register of Historic Places, the State Register of Historic Properties, listed as a local historic landmark by a Certified Local Government (CLG), or designated as a contributing resource in a designated historic district listed in the National Register, State Register, or by a CLG. The state legislature amended the STC program in 2014, creating separate tax credit programs for commercial and residential properties, thus greatly expanding the incentives for rehabilitation, especially commercial properties. Prior to July 2015 (when the new tax credit programs came into effect), the program allowed a credit of 20 percent of $5,000 or more of approved rehabilitation expenditures on any property over 50 years old and listed in the State Register of Historic Properties or listed as a local landmark or contributing resource in a historic district by a CLG. Tax credit amounts were capped at $50,000 for all properties, even if that property was sold to a new owner.

2014 Updates to the State Tax Credit Program

While the tax credit program for residential projects is similar to the previous one, the time limit for completing a project was eliminated, as was the lifetime cap of $50,000 per property, which now resets every ten years or with new ownership. The new residential tax credit program also awards an additional five percent credit to the original 20 percent for properties located in areas that have been declared disaster areas by the President of the United States or the Governor of Colorado within the past 6 years. The new program for commercial tax credits is designed to encourage much larger rehabilitation projects (in terms of project costs). While eligibility requirements remain the same, project costs must now exceed 25 percent of the property owner’s original purchase price minus the value attributed to the land in order to qualify for the tax credit. If this condition is met, the first $2 million spent on qualifying rehabilitation expenditures is eligible for a tax credit of 25 percent, with expenditures in excess of $2 million eligible for a 20 percent tax credit. In addition, the maximum value of a tax credit for a commercial project is increased to $1 million each year with no lifetime caps. Another major change allows recipients of a commercial tax credit to sell the credit once the project is complete, creating additional funds that can be used on the project as a cash match (e.g., for an SHF grant), or for a loan. The 2014 updates to the program also removed its recapture clause —the requirement that the value of tax credits be recaptured if the building is sold within five years of completing a tax credit-funded project.

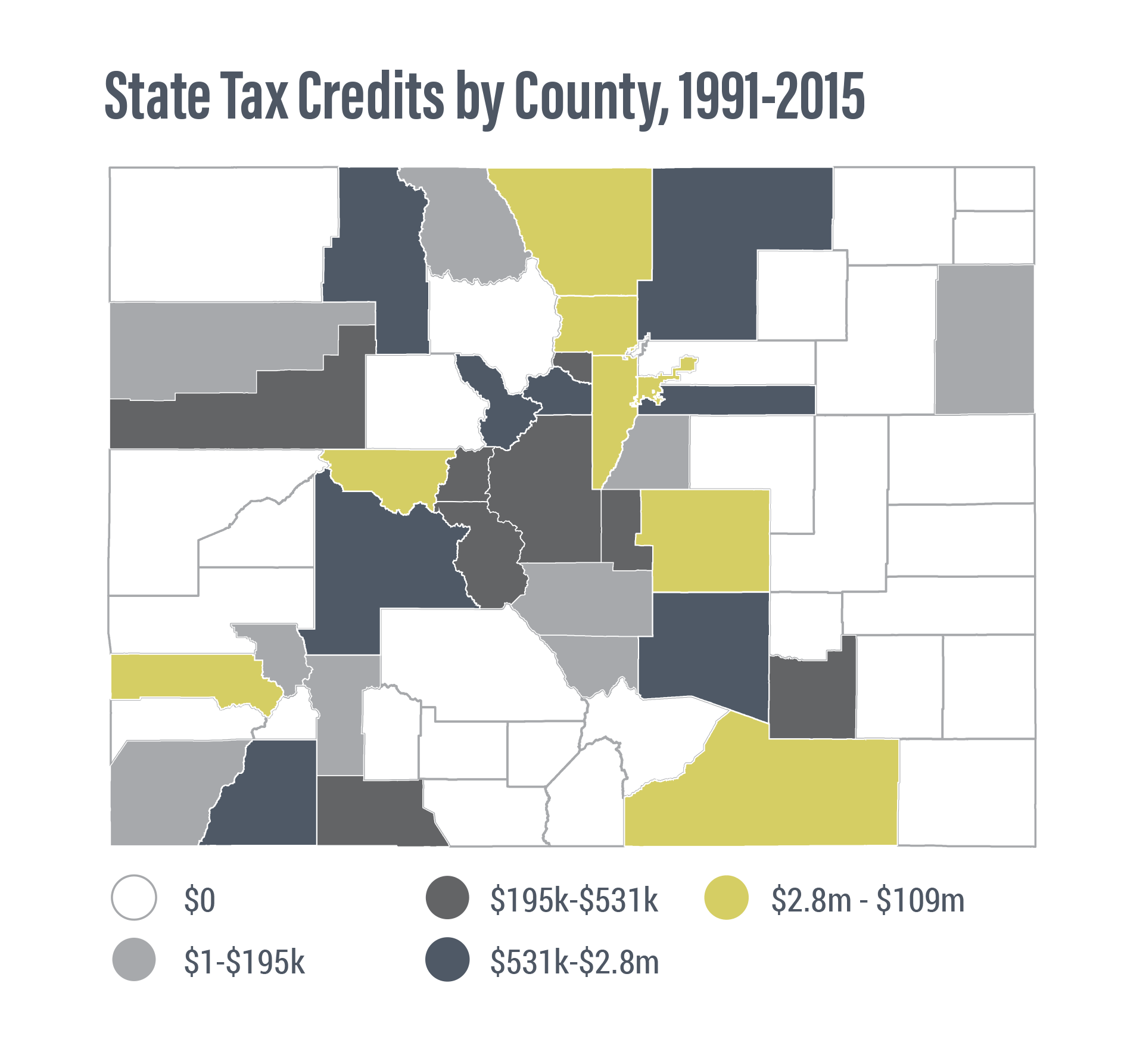

Distribution of state tax credits by county between 1991 and 2015.

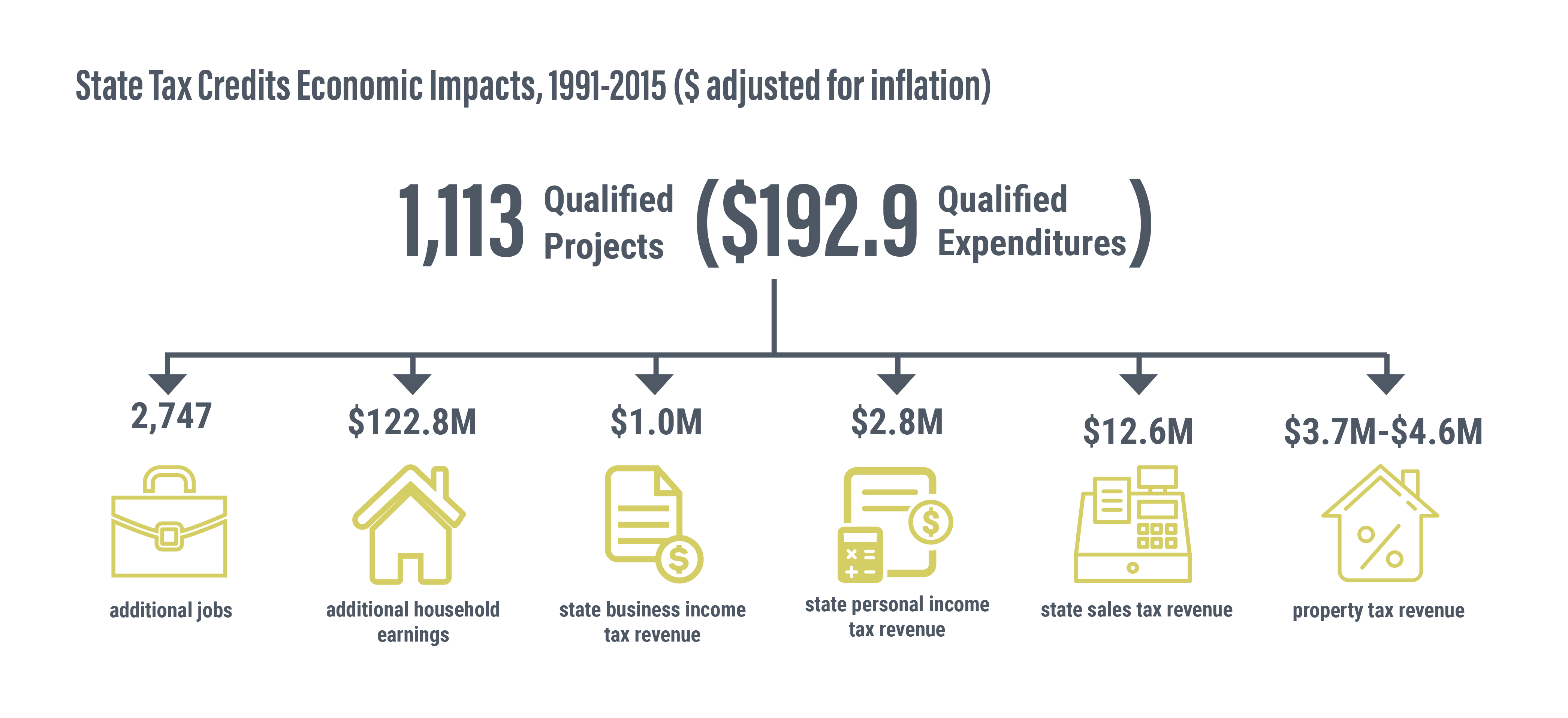

Distribution of state tax credits by county between 1991 and 2015.  Between 1991 and 2015, 1,113 qualified state tax credit projects (totaling $192.9 million in qualified expenditures) resulted in 2,747 additional jobs, $122.8 million in additional household earnings, $1 million in state business income tax revenue, $2.8 million in state personal income tax revenue, $12.6 million in state sales tax revenue, and between $3.7 million and $4.6 million in property tax revenue.

Between 1991 and 2015, 1,113 qualified state tax credit projects (totaling $192.9 million in qualified expenditures) resulted in 2,747 additional jobs, $122.8 million in additional household earnings, $1 million in state business income tax revenue, $2.8 million in state personal income tax revenue, $12.6 million in state sales tax revenue, and between $3.7 million and $4.6 million in property tax revenue.

Economic Impacts of the Rehabilitation Tax Credit Programs

Between 1981 and 2015, 380 projects in Colorado took advantage of the federal tax credit. The qualified rehabilitation expenditures of these projects was approximately $1.03 billion ($640.3 million in non-inflation-adjusted dollars). Between 1991 and 2015, 1,113 projects received state tax credits with qualified rehabilitation expenditures totaling $192.9 million ($157.1 million).

Cumulative Economic Impacts

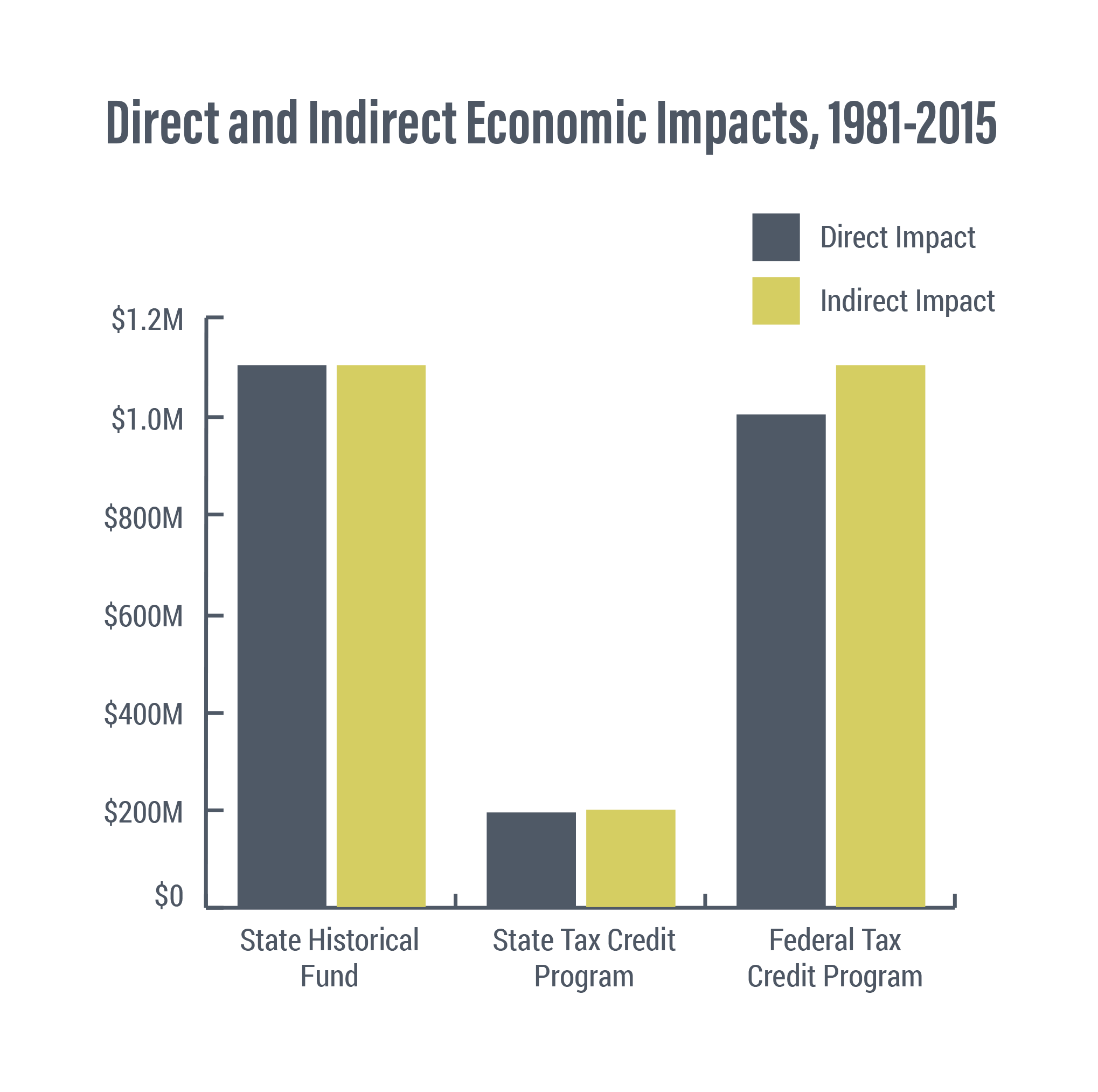

Direct and Indirect Economic Impacts

Taken together, spending on preservation projects as a direct result of these three programs (the SHF, the federal tax credit, and the state tax credit) represents a good measure of the economic impacts from the rehabilitation of historic properties in Colorado. When assessing the economic impacts of any spending in an economy, it is important to consider not just the direct impacts, or the money spent directly on or due to a project, but also the impacts such spending has as the original spending on a project ripples through the economy. These impacts, known as indirect impacts, are commonly combined with direct impacts to arrive at the total or cumulative economic impact for a project that results in spending in an economy.

An example of an indirect benefit is when a construction worker spends the wages earned on a preservation project on household items like groceries. This spending was made possible in part due to the initial spending associated with the preservation project, and in turn helps the grocery store where the construction worker purchased the groceries to, for example, pay its employees’ wages.

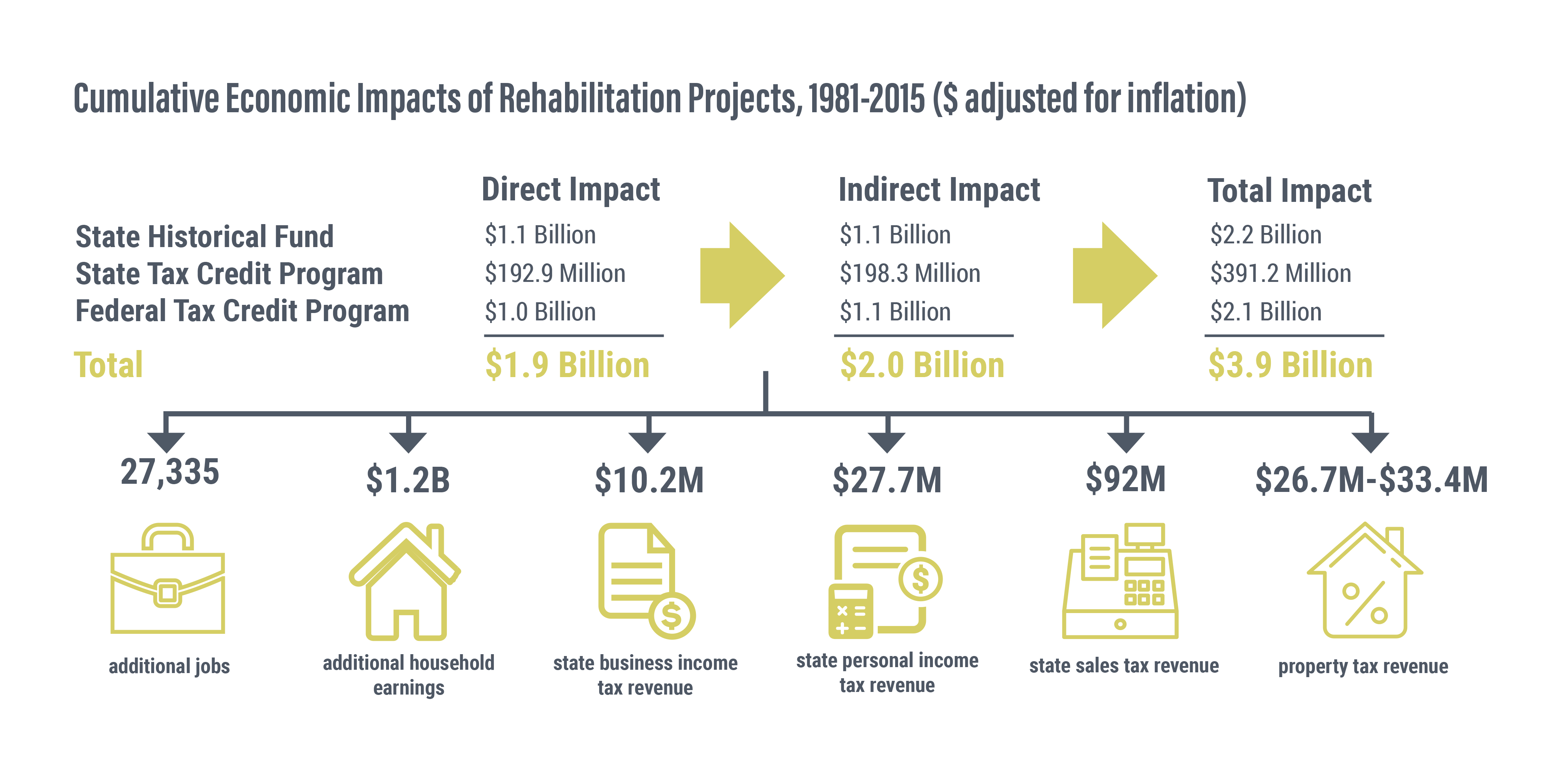

Between 1981 and 2015, the cumulative economic impacts of rehabilitation projects for the State Historical Fund, State Tax Credit Program, and Federal Tax Credit Program are as follows. Cumulative direct impact was $1.9 billion, cumulative indirect impact was $2.0 billion, and cumulative total impact was $3.9 billion. This cumulative total impact resulted in 27,335 additional jobs, $1.2 billion in additional household earnings, $10.2 million in state business income tax revenue, $27.7 million in state personal income tax revenue, $92 million in state sales tax revenue, and between $26.7 million and $33.4 million dollars in property tax revenue.

Between 1981 and 2015, the cumulative economic impacts of rehabilitation projects for the State Historical Fund, State Tax Credit Program, and Federal Tax Credit Program are as follows. Cumulative direct impact was $1.9 billion, cumulative indirect impact was $2.0 billion, and cumulative total impact was $3.9 billion. This cumulative total impact resulted in 27,335 additional jobs, $1.2 billion in additional household earnings, $10.2 million in state business income tax revenue, $27.7 million in state personal income tax revenue, $92 million in state sales tax revenue, and between $26.7 million and $33.4 million dollars in property tax revenue.

Economic Multipliers

While it is easy to measure and track direct impacts, indirect impacts are more difficult to quantify. Economists frequently use economic “multipliers” to estimate the effect that overall spending has in other sectors of the regional economy (i.e., indirect impacts), as well as on household earnings and employment. This report makes use of the regional economic multipliers developed for Colorado by the U.S. Bureau of Economic Analysis (BEA) for its Regional Input-Output Modeling System (or RIMS II). RIMS II multipliers are available to estimate the impacts from new spending in an economy in over 360 industries. While historic preservation is not represented among these, the construction maintenance and repair industry fits best with the type of activities involved in rehabilitation work. As such, the multipliers for this industry were used in this report to arrive at the cumulative economic impacts arising from spending on historic preservation in Colorado. More information on the multipliers and methodology used are available in the accompanying Technical Report.

Cumulative Economic Impacts

Adjusting for spending on projects that took advantage of more than one program, the three rehabilitation programs examined in this report (roughly $372 million, adjusted for inflation) resulted in a cumulative direct impact of approximately $1.92 billion ($1.31 billion in non-inflation-adjusted dollars) between 1981 and 2015. This direct spending on preservation projects in the state resulted in an additional $1.97 billion ($1.35 billion) in indirect impacts, for a cumulative economic impact of $3.9 billion ($2.7 billion). In turn, the additional economic activity generated by historic preservation added $2.2 billion ($1.5 billion) to Colorado’s gross domestic product (GDP).

The spending that results from rehabilitation projects also lead to more tangible benefits that can be felt in communities across the state. As shown below, money spent on rehabilitation projects supports jobs (“jobs” in this instance refers to full-time employment for one person for one year), leads to higher household earnings, and generates tax revenue for state and local governments, which in turn can be used to fund additional services, programs, or initiatives that may have a direct impact on residents.

Every $1 million spent on historic preservation in Colorado leads to $1.03 million in additional spending, 14 new jobs, and $636,700 in increased household income across the state.

In sum, every $1 million spent on historic preservation or rehabilitation projects in Colorado in 2015 leads to $1.03 million in indirect expenditures, 14 new jobs, and $636,700 in increased household incomes. These impacts compare favorably to new construction, which leads to slightly more indirect spending and jobs. Specifically, spending $1 million on new residential and non-residential construction in Colorado leads to $1.15 million and $1.16 million in indirect expenditures, respectively. This additional spending in these industries also leads to 14 and 18 additional jobs, respectively, similar to the impacts associated with spending on historic preservation. The same is true when comparing preservation to specific industries in the state. For instance, $1 million in direct spending attributable to oil and gas drilling in 2015 led to just $856 thousand in indirect spending, and creates only 9 new jobs.